College students in San Antonio turning to title loans for education costs face high interest rates and short repayment terms, risking vehicle loss and financial strain. Effective budgeting, exploring refinance options, making extra payments, and negotiating better terms empower students to manage debt and control their financial future instead of being trapped in a burdensome cycle.

Many college students turn to title loans as a quick solution for funding education, but these short-term fixes can quickly become overwhelming. This article provides actionable tips to help students pay off title loans faster. By understanding the loan’s impact, creating a budget, exploring refinance options, and making extra payments, you can break free from debt sooner. These strategies empower students to regain control of their financial future and focus on academic success.

- Understand the Impact of Title Loans on Students

- Create a Budget to Accelerate Loan Repayment

- Explore Refinance Options and Extra Payments

Understand the Impact of Title Loans on Students

Many college students find themselves turning to alternative financing options to cover educational expenses, and one such method is through title loans. It’s crucial for students to understand the implications of this type of loan, as it can significantly impact their financial future. Title loans for college students often provide quick access to cash, but they come with high-interest rates and shorter repayment periods, making them a potentially burdensome debt option.

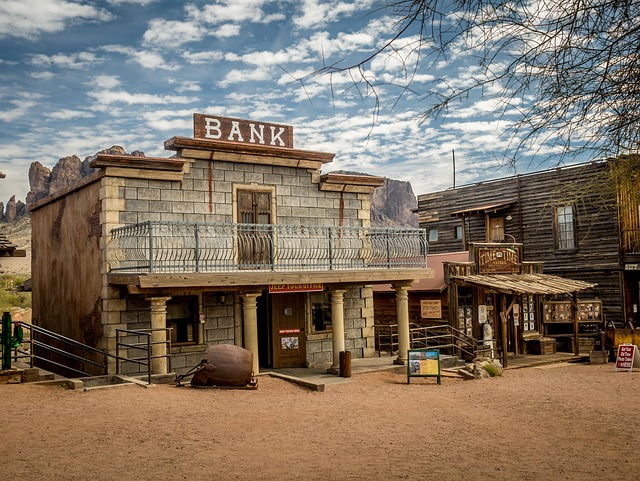

In the case of San Antonio loans or Truck Title Loans, students may be lured by the ease of obtaining funds, especially when facing urgent financial needs. However, the title loan process can quickly spiral out of control if not managed carefully. Students should be aware that these loans often require the use of their vehicle as collateral, leaving them at risk of losing their transportation means if they fail to repay on time. This can further hinder their ability to attend classes and manage daily life, creating a challenging cycle of debt.

Create a Budget to Accelerate Loan Repayment

Managing your finances effectively is a key step in paying off your Title loans for college students faster. One powerful tool to achieve this is by creating a detailed budget. Start by listing all your income sources, including any financial aid or part-time job earnings. Then, categorize your expenses into fixed (rent, utilities) and variable (groceries, entertainment). This process will help you understand where your money is going and identify areas for potential cuts.

By streamlining your budget, you can allocate more funds towards loan repayment. Consider using the extra cash from quick funding or a recent job offer to make larger than usual payments on your title loans. Even a small increase in monthly repayments can significantly reduce the overall interest paid and shorten the loan term, offering a much-needed financial relief for college students looking for quick approval and a way out of debt through loan refinancing.

Explore Refinance Options and Extra Payments

One effective strategy for paying off title loans for college students faster is to explore refinance options. Many lenders offer refinancing programs tailored to help borrowers reduce interest rates and loan terms, thereby speeding up repayment. Additionally, making extra payments above the minimum due can significantly shorten the lifespan of your loan. This approach not only saves you money in interest but also gives you more financial freedom as it reduces the overall debt burden.

For instance, if you have a Boat Title Loan or a Title Pawn in San Antonio, consider negotiating a lower interest rate or exploring alternative financing options that offer better terms. Additionally, any extra funds available should be applied towards your principal balance to avoid paying interest on interest. This proactive approach can help college students pay off their title loans more swiftly and gain control over their financial future.

Paying off title loans for college students faster requires understanding the loan’s impact, creating a strict budget, exploring refinance options, and making extra payments whenever possible. By implementing these strategies, you can significantly reduce interest accrued and gain financial freedom sooner. Remember, proactive management of your title loans is key to navigating your student debt effectively.