College students increasingly turn to title loans for college students as a quick funding source for tuition and expenses, avoiding traditional loan obstacles. Online platforms offer easy applications, same-day funding, flexible terms, and competitive rates. However, students must carefully consider potential risks like security issues, fees, short terms, and repayment challenges before pledging their vehicles as collateral.

In today’s digital age, college students seeking financial aid have a myriad of online options. One alternative gaining traction is the concept of title loans for college students. This article explores this unique financing avenue, delving into how undergraduate students can access these loans digitally. We’ll dissect the process, highlight various online platforms, and weigh the pros and cons of going the digital route for title loans specifically tailored to meet the needs of today’s academic landscape.

- Understanding Title Loans for College Students

- Online Platforms for Student Loan Options

- Pros and Cons of Digital Title Loans for Undergraduates

Understanding Title Loans for College Students

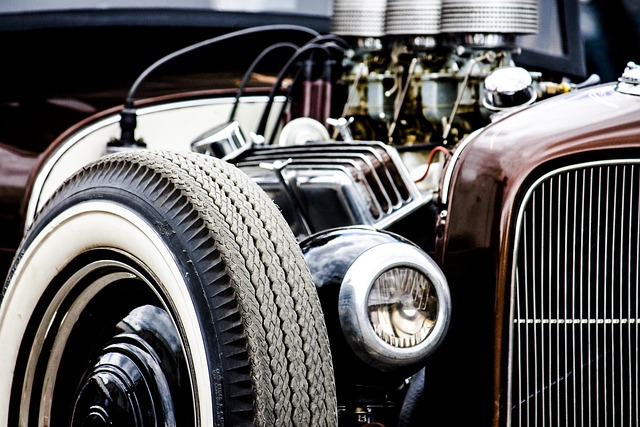

Many college students wonder if they can access financial support for their education through unique lending options. One such option gaining popularity is title loans for college students. These loans, secured against a student’s vehicle (typically a car or motorcycle), offer a fast and accessible way to secure funding for tuition, books, and other expenses. The process involves using the student’s vehicle title as collateral, which allows them to borrow money while keeping their vehicle.

This alternative financing method is particularly appealing for students who may have limited credit history or face challenges in obtaining traditional loans. With motorcycle title loans as an option, students can take control of their financial needs during their academic journey. The loan approval process typically requires a simple application, proof of enrollment, and the vehicle’s registration and title. However, it’s crucial to understand the terms and conditions, including interest rates and repayment plans, before pledging one’s vehicle as collateral.

Online Platforms for Student Loan Options

In today’s digital era, navigating financial assistance options for college students has become more accessible with the rise of online platforms. Many students are turning to alternative loan sources, such as title loans for college students, to supplement their education expenses. These online platforms offer a wide range of loan choices, including semi truck loans and traditional personal loans, catering to various financial needs. The convenience of applying for these loans from the comfort of one’s home is a significant draw, especially for those who may not have access to traditional banking services or require same-day funding.

By exploring these online avenues, students can explore flexible loan terms and competitive interest rates, making financial management during their academic journey easier. This shift towards digital financial solutions not only provides quick access to funds but also empowers students to take control of their finances. With a variety of options available, students can now find tailored financial assistance to support their college experience without the hassle of traditional loan application processes.

Pros and Cons of Digital Title Loans for Undergraduates

For undergraduate students facing financial constraints, the idea of title loans for college students online has gained traction as a potential solution for quick funding. This modern approach offers several advantages over traditional loan methods. Firstly, digital title loans can be accessed easily from the comfort of one’s home, eliminating the need for physical visits to lenders. This convenience is especially beneficial for busy students with limited time. Secondly, these loans often provide quick funding, ensuring that students can swiftly address their financial emergencies, whether it’s paying for unexpected expenses or tuition fees.

However, there are considerations to keep in mind. The online nature may introduce potential risks, such as security concerns and hidden fees. Students should thoroughly research lenders to ensure legitimate practices. Furthermore, while the application process is streamlined, digital title loans typically have shorter loan terms compared to conventional loans, demanding prompt repayment. This can be challenging for students with fluctuating incomes or unexpected delays in financial aid. Balancing these pros and cons is crucial for undergraduates considering this alternative financing method to bridge their emergency funds.

In today’s digital age, exploring online options for financial support is a natural step, especially for college students. When it comes to title loans, there are now reputable platforms that cater specifically to students, offering convenient and potentially faster access to funds. However, as with any loan, it’s crucial to weigh the pros and cons thoroughly. Students should carefully consider their repayment capabilities and alternative funding sources before opting for a digital title loan. Understanding these options empowers undergraduates to make informed decisions regarding their financial future.